Protecting Your Legacy With A Living Trust

When you are looking to avoid probate of your estate and have control over your property now and after you pass away, a revocable living trust may be the answer for you. A revocable, sometimes called “living,” trust, is a type of trust that you can revoke or amend while you (the grantor) are still alive. The trust becomes irrevocable upon your death. If you are interested in exploring your options with trusts, contact me, attorney Aaron Nelson, at The Nelson Law Firm to discuss them. I have extensive experience in estate planning and tax law.

What Are The Benefits Of A Revocable Trust?

As the grantor, you can use all the assets in the trust during your life. Many grantors choose to act as the original trustee for the trust, as well, then pass that role along to another person when they become incapacitated or die. You can continue to spend any liquid assets placed in the trust and can continue to live in any residences placed in the trust. The benefits of a revocable trust are truly realized upon your death or incapacity.

A revocable trust allows the assets in the trust to avoid the probate process and the fees, both to the court and to attorneys who go along with the probate process. It is possible with a completely funded revocable trust – one in which all the grantor’s (otherwise probate) assets are placed in the trust before the grantor’s death – to avoid the probate process altogether.

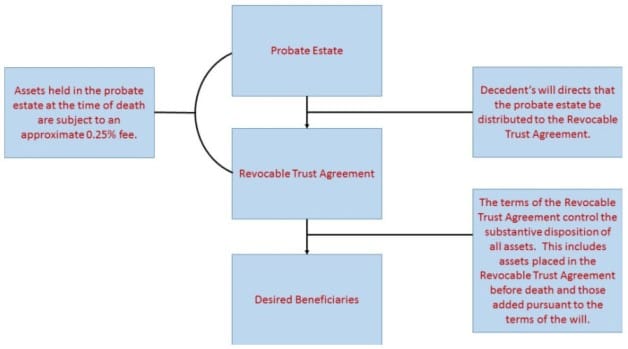

Grantors often use revocable trusts in connection with a “pour-over” will, in which the grantor directs that any probate assets not already in the trust be distributed to the trust upon their death. The revocable trust contains the instructions for the distribution of the individual’s estate plan. The diagram below shows how this process works.

Funding A Revocable Trust

Too often, people go to the trouble and expense of creating a trust but do not take the important step of putting their assets into the trust, also called funding the trust. Only those assets transferred to the trust during the grantor’s life will avoid probate and the associated fees.

In order to fund a revocable trust, the grantor should retitle assets into the trustee’s name on behalf of the trust. Examples include retitling:

- Bank accounts

- Partnership or LLC interests

- Corporate stock

- Deeds for real property

This will allow the trustee to take control of the assets and manage them according to the terms in the trust.

Find Out More About Your Trust Options

You may contact me at The Nelson Law Firm for answers to your revocable living trust questions. I can provide you with full-service estate planning from my office in Bluffton. For a consultation, please call me at 843-548-0157, send an email to [email protected] or complete my online form.

.